Income Tax Return Login Registration Sars Efiling

21 november 2008 efiling submissions.

Income tax return login registration sars efiling. Log on to e filing portal at https incometaxindiaefiling gov in. Note the tax period matches the tax season you are filing for. Under return type click itr12.

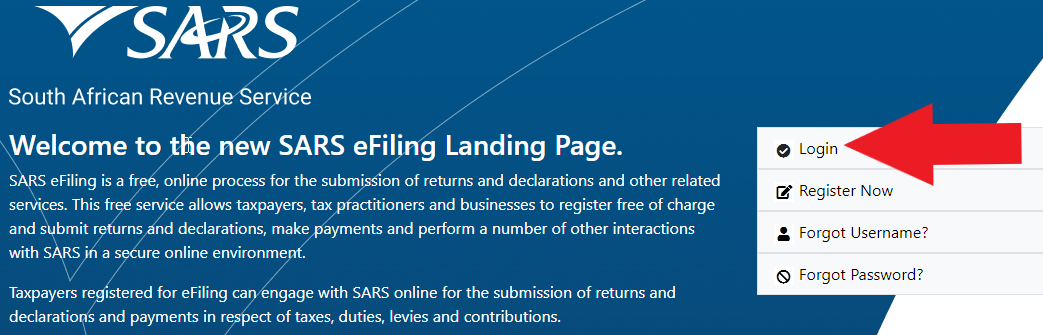

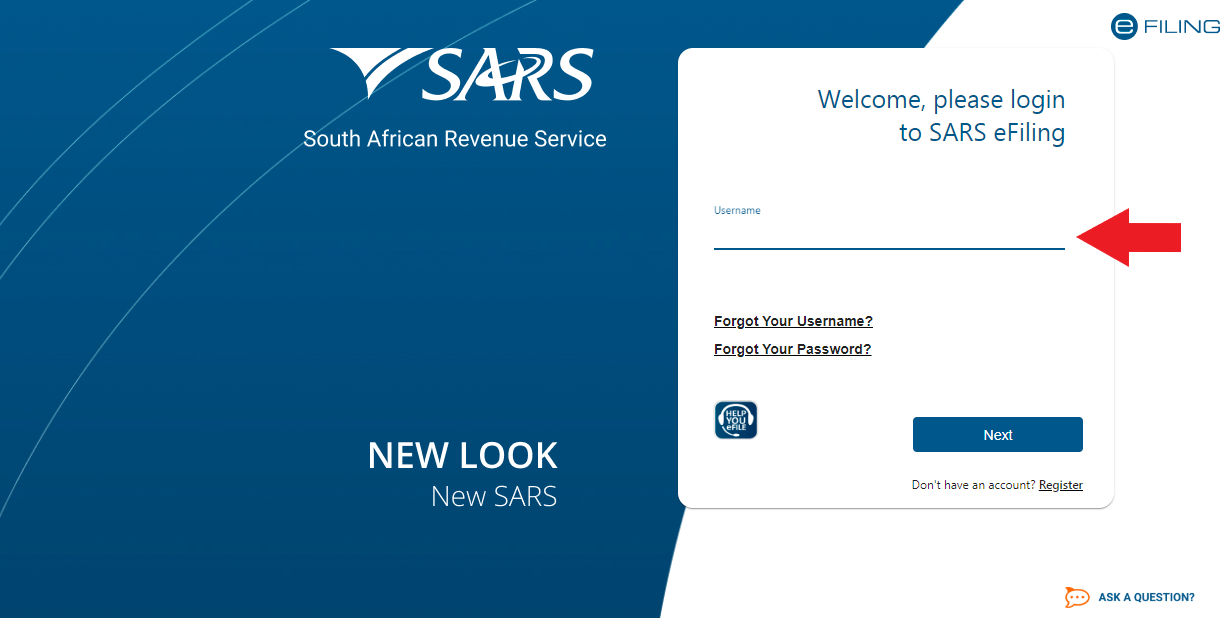

Registration for and the use of efiling is free. 23 january 2009 new users. Sars efiling is a free online process for the submission of returns and declarations and other related services.

E filing individual tax return year of assessment 2020 2021. The 2020 year of assessment commonly referred to as a tax year runs from 1 march 2019 to 29 february 2020. When using your login and password your income tax form will be pre filled with data currently available at mra.

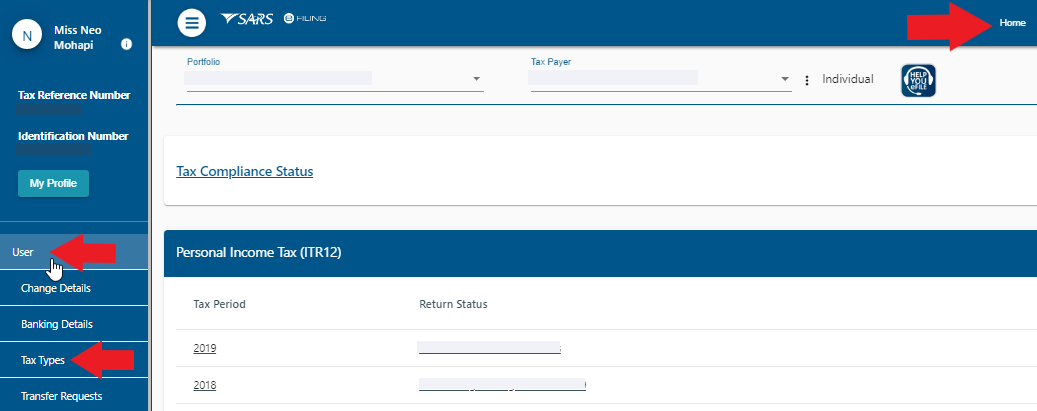

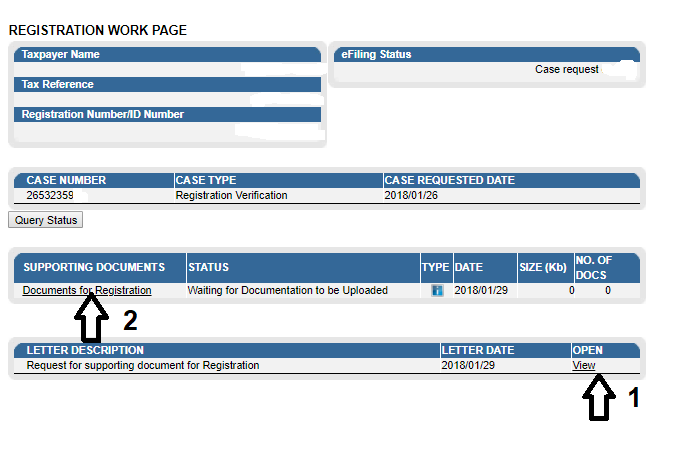

After reading the information pop up important info you will then find yourself on the income tax work page of sars efiling. You will need to register as an efiling user before you can fi le your income tax return electronically. Your tax registration number s.

27 march 2020 auto registration for personal income tax when you register for sars efiling for the first time and you do not yet have a personal income tax number sars will automatically register you and issue a tax reference number. You may be one of them. If you are not registered with the e filing portal use the register.

You will have the possibility to change the information in the form prior to submission. See the tax tables. In 2014 income tax department has identified additional 22 09 464 non filers who have done high value transactions.

To register go to www. To enjoy the full benefits and convenience of efiling you need to first register to gain secure access to your own tax information. All you need is internet access.

Every year sars announces its tax season a period during which you are required to submit your annual. Register for efiling deadlines for individual taxpayers manual submissions. This free service allows taxpayers tax practitioners and businesses to register free of charge and submit returns and declarations make payments and perform a number of other interactions with sars in a secure online environment.

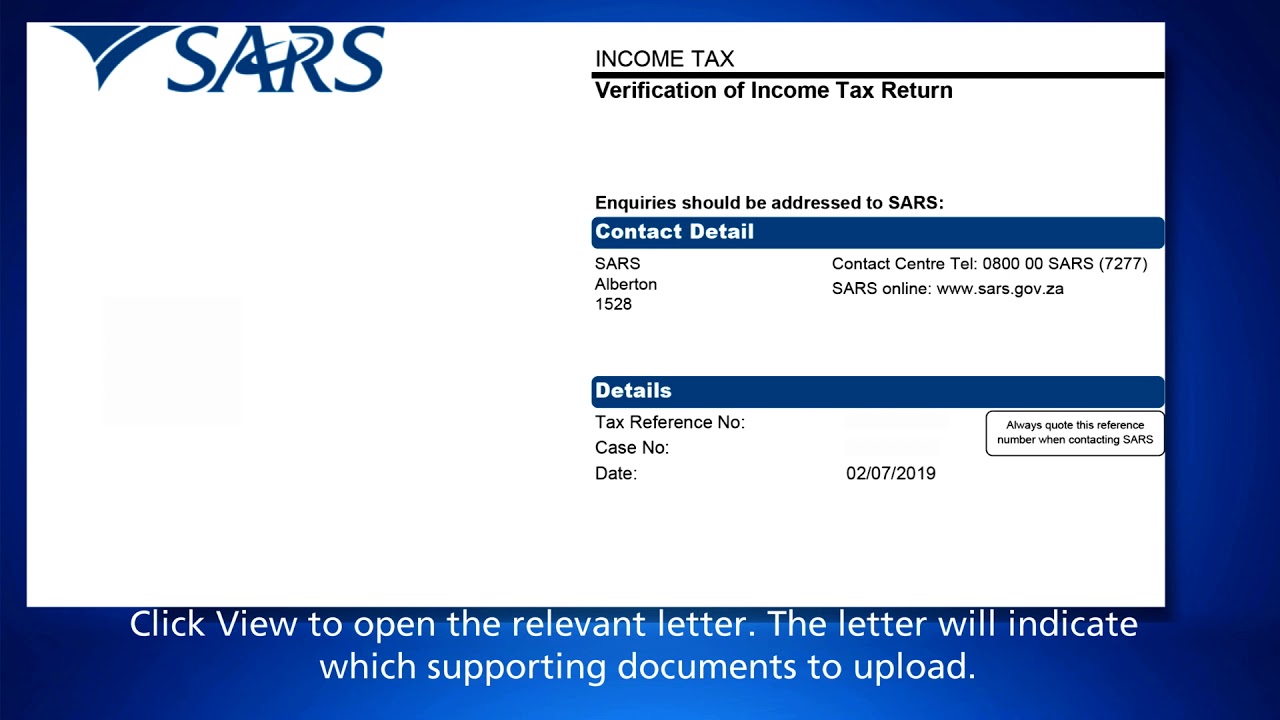

If you are registered for income tax you will be required to submit an annual income tax return to sars. In 2013 income tax department issued letters to 12 19 832 non filers who had done high value transactions. This page summarises your tax return for the year.