Income Tax Calculator Malaysia For Expats

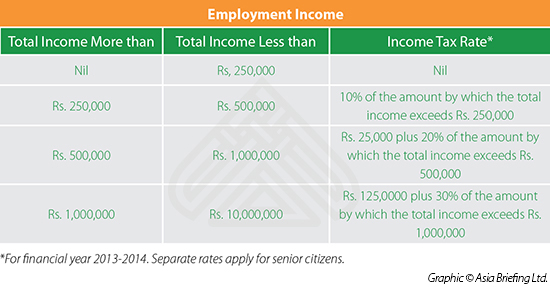

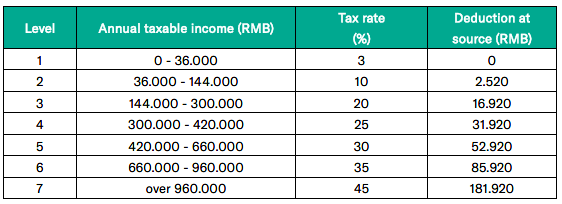

This means that low income earners are imposed with a lower tax rate compared to those with a higher income.

Income tax calculator malaysia for expats. All tax returns must be completed and returned before april 30 of the following year. If you make rm 70 000 a year living in malaysia you will be taxed rm 10 582 that means that your net pay will be rm 59 418 per year or rm 4 952 per month. To file your income tax the expatriate will need to obtain a tax number from the inland revenue board of malaysia irb.

For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. According to section 45 of malaysia s income tax act 1967 all married couples in malaysia have the right to choose whether to file individual or joint taxes. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make sure you.

If you need to check total tax payable for 2019 just enter your estimated 2019 yearly income into the bonus field leave salary field empty and enter whatever allowable deductions for current year to calculate the total amount of tax for current year. Malaysia personal income tax calculator for ya 2020 malaysia adopts a progressive income tax rate system. However if the company has failed to obtain one the worker can register for an income tax number at the nearest irb office.

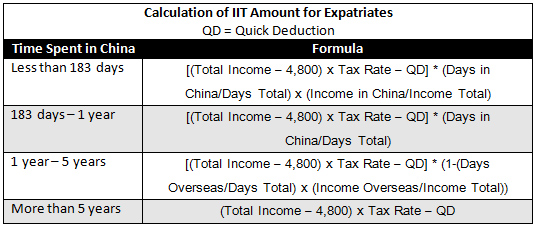

Calculation of yearly income tax for 2019. So we ve prepared this guide to help make this task a little less arduous. To file income tax an expatriate needs to obtain an income tax number from the inland revenue board of malaysia irb.

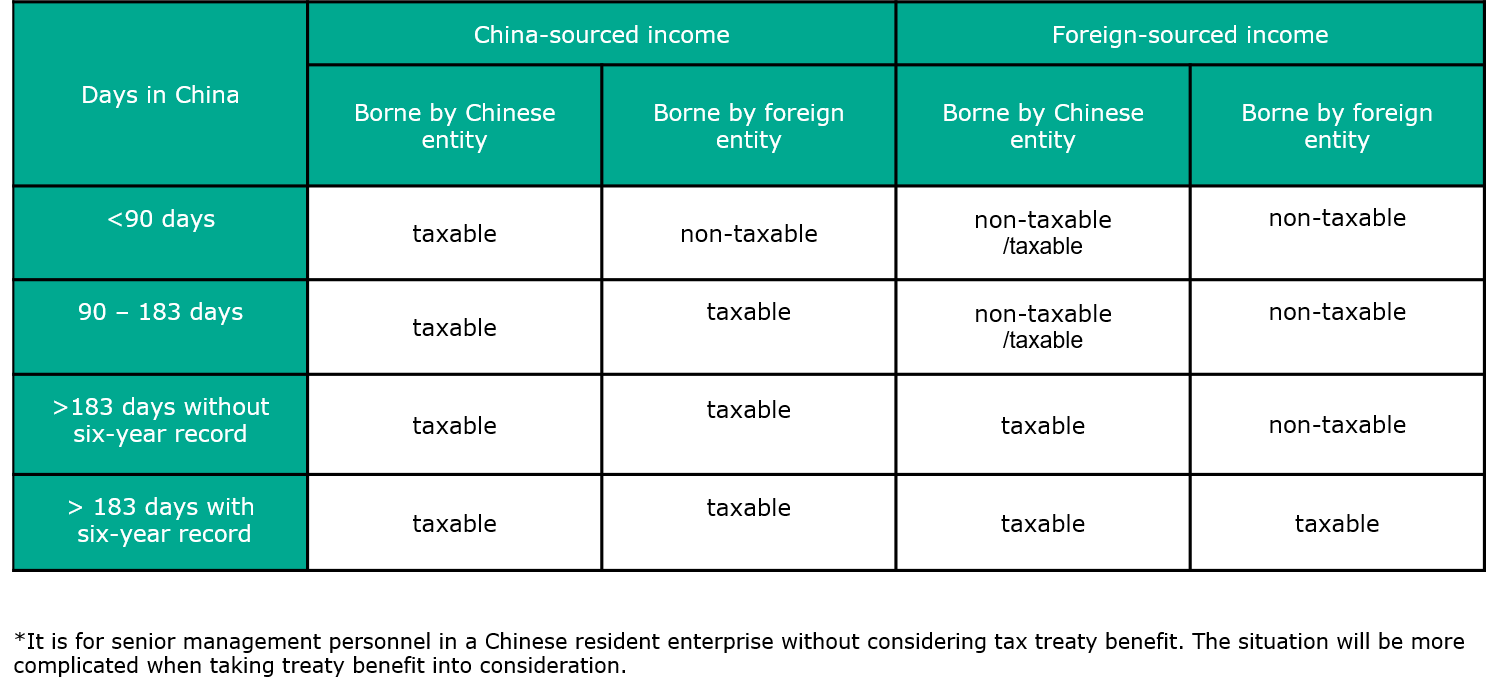

Filing and paying taxes can be daunting especially if you re an expat. It s important to know that all tax residents and non residents of malaysia this includes every person in the country regardless of nationality. Income tax calculator for non resident individuals xls 67kb compute income tax liability for non resident individuals locals and foreigners who are in singapore for less than 183 days 6.

In malaysia the tax year runs in accordance with the calendar year beginning on january 1 and ending on december 31. As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs and deductibles available. Normally companies will obtain the income tax numbers for their foreign workers.

The system is thus based on the taxpayer s ability to pay. Area representative travel calculator xls 46kb compute number of business days for area representative scheme. This guide will focus on income tax for individuals.

Your average tax rate is 15 12 and your marginal tax rate is 22 50 this marginal tax rate means that your immediate additional income will be taxed at this rate.