How To Pay Lhdn Penalty Online

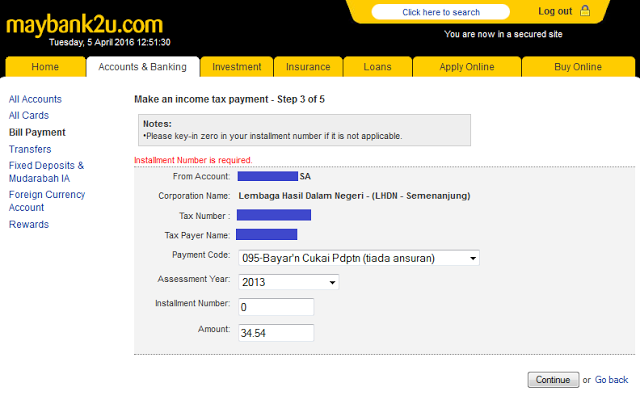

Payment code is referring to the type of tax that categorized by inland revenue board irb or lembaga hasil dalam negeri lhdn malaysia.

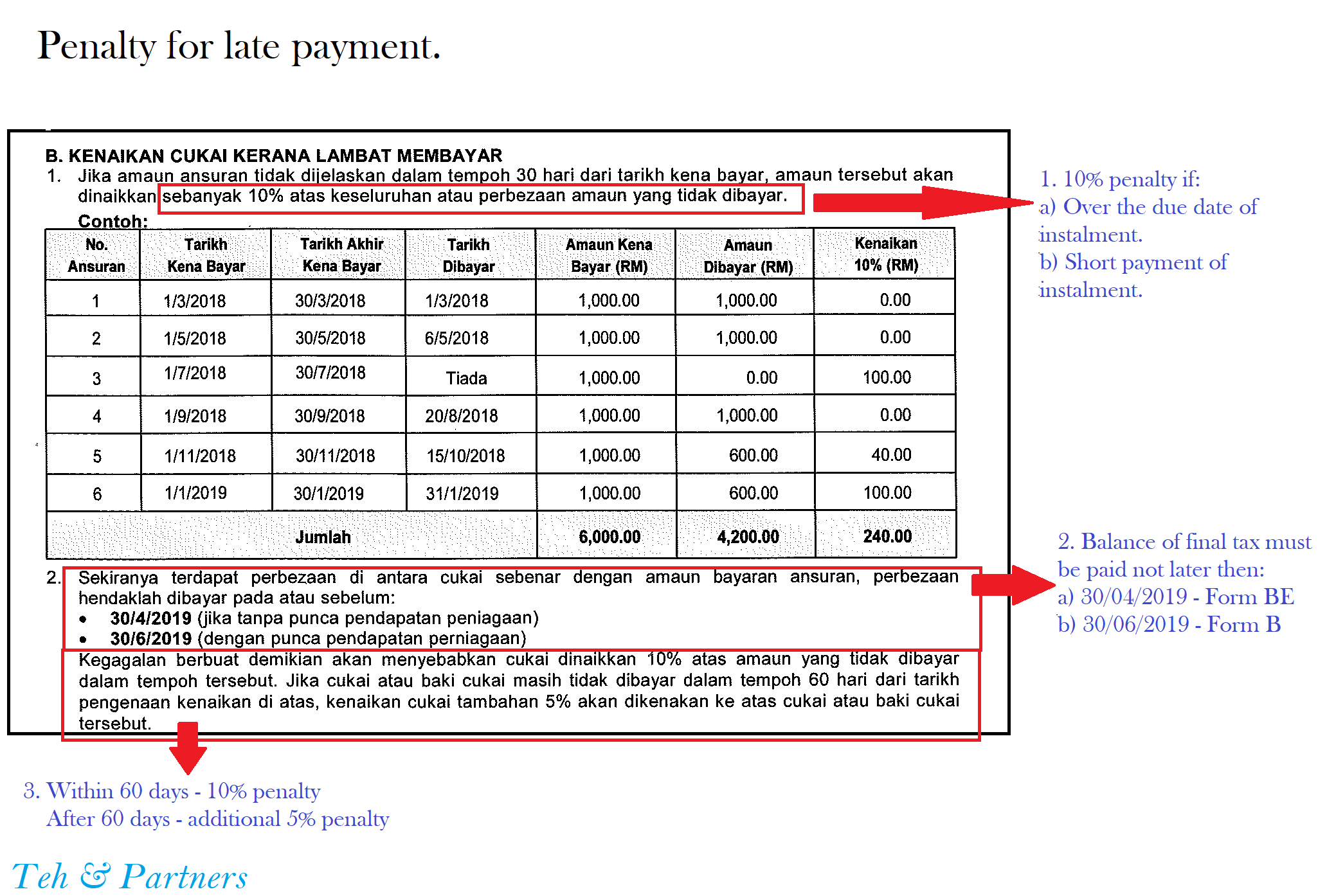

How to pay lhdn penalty online. Inland revenue board irb lembaga hasil dalam negeri lhdn malaysia has made it very easy for you as a taxpayer to pay your taxes. The employer can also pay manually by using form cp39 or cp39a. If the tax and penalty imposed is not paid within 60 days from the date the penalty is imposed a further penalty of 5 will be imposed on the amount still owing.

Sign up for this service today to enjoy the speed and convenience of online banking. If you failed to make the full payment after april 30 following the year of assessment you will be charged a late payment penalty of 10 on the balance of tax not paid. Bayaran cukai melalui fpx perkhidmatan ini menggunakan fpx sebagai gateway untuk pembayaran cukai.

You have the options to pay them directly to lhdn via fpx financial process exchange services or through the many appointed agents. Item payment code. Visit the lhdn website to download the application.

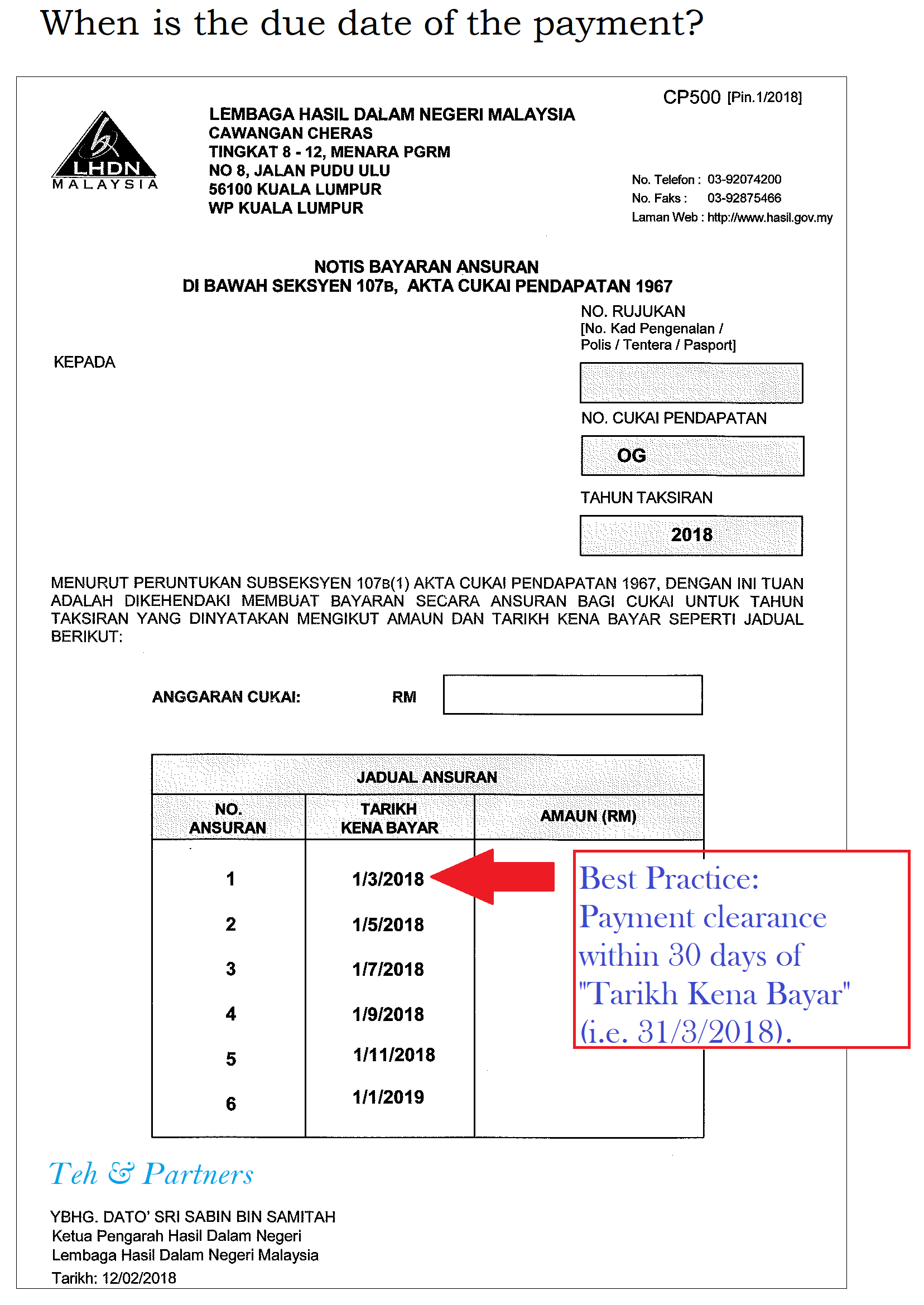

Penalty payment for rpgt acquirer. If the tax payable and penalty is still outstanding within 60 days from the due date an additional penalty of 5 will be imposed on the tax and penalty outstanding. Penalty for late payment a late payment penalty of 10 will be imposed on the balance of tax not paid after 30th april following the year of assessment.

Details on tax payment code are tabulated in the table below. Payment at irbm s payment counter can be made by filling in and submitting form cp39 amended 1 08 or cp39a pin 2010. However if you are using the cp 39 form you are able to generate a pcb file by using an microsoft excel application provided from lhdn.

Long answer if caught by the lhdn s auditor you ll face a penalty ranging from 80 to 300 of the taxable amount. That s a lot of money people. Pengguna perlu mempunyai akaun perbankan internet dengan mana mana bank yang menyertai fpx.

Appeal on penalty an appeal in writing within 30 days from the statement of account can be submitted to the relevant branch collections unit if the company does not agree with the late payment penalty imposed. For example if your total taxable amount is just rm500 now you have to pay rm1 500 because of the 300 penalty. Payment at irbm payment counter 1 submitting form cp 39 or cp 39a manually.