How To Pay Advance Income Tax Online India

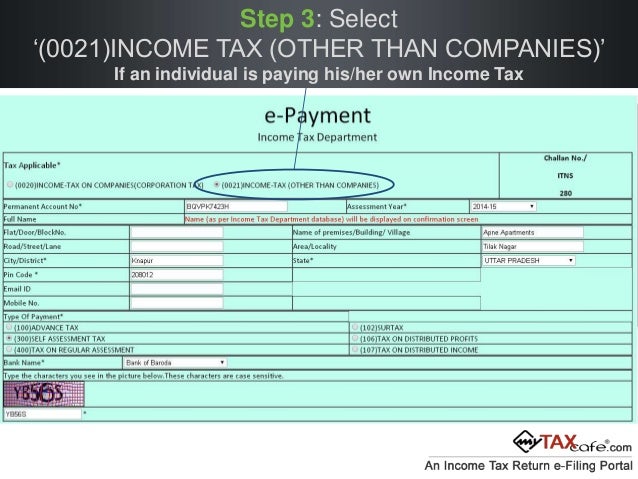

Thus he is required to pay the amount of advance tax in the following.

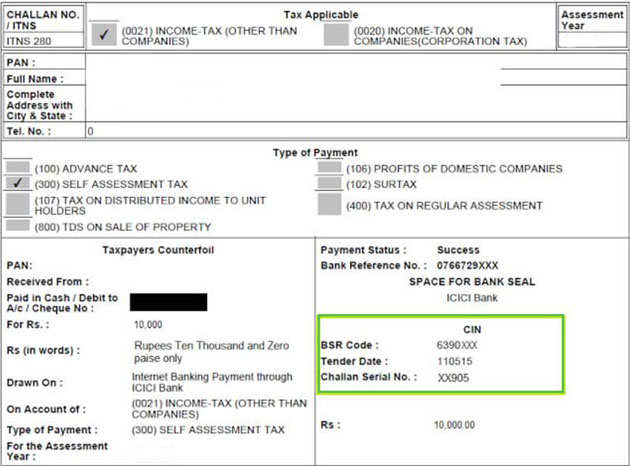

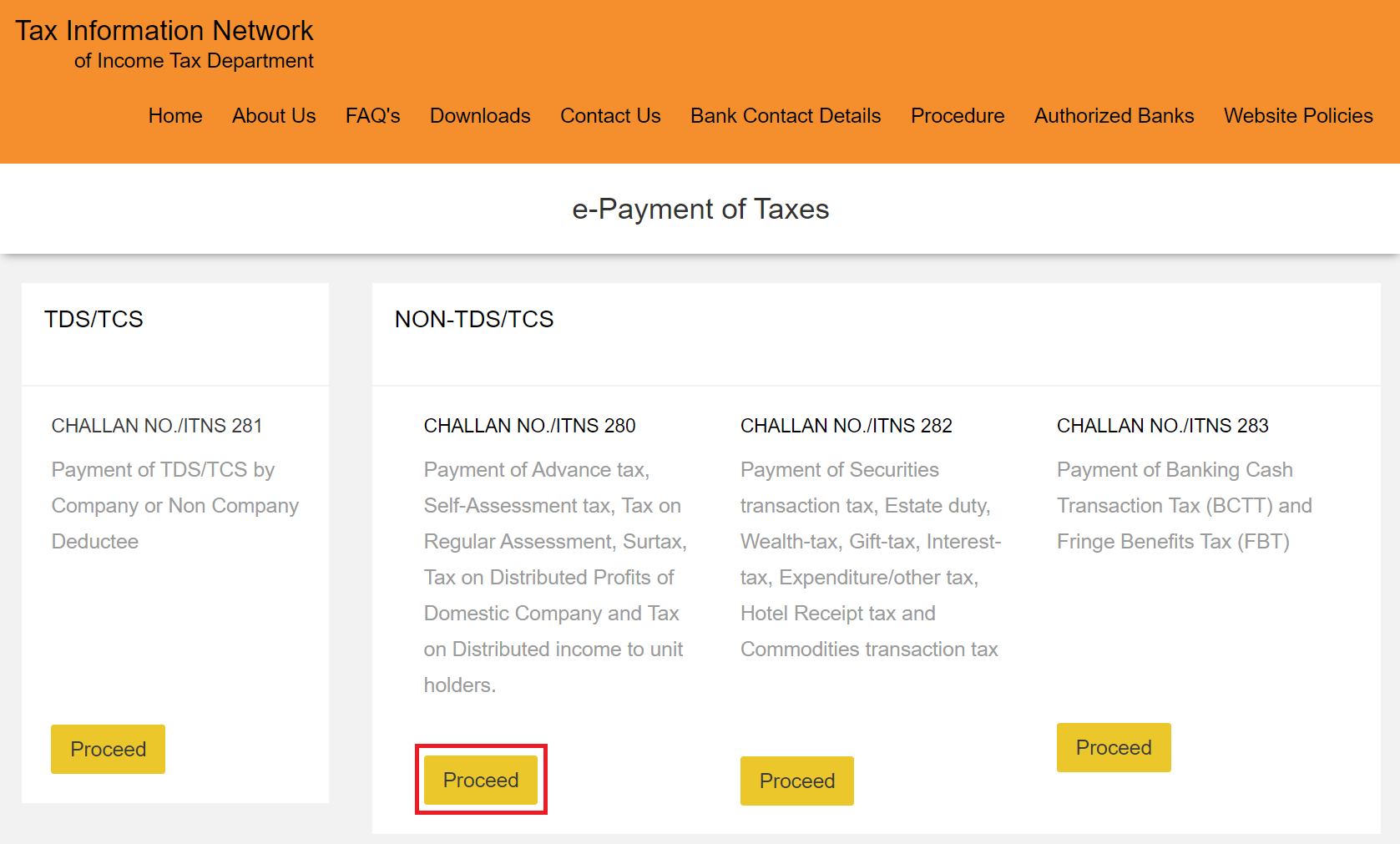

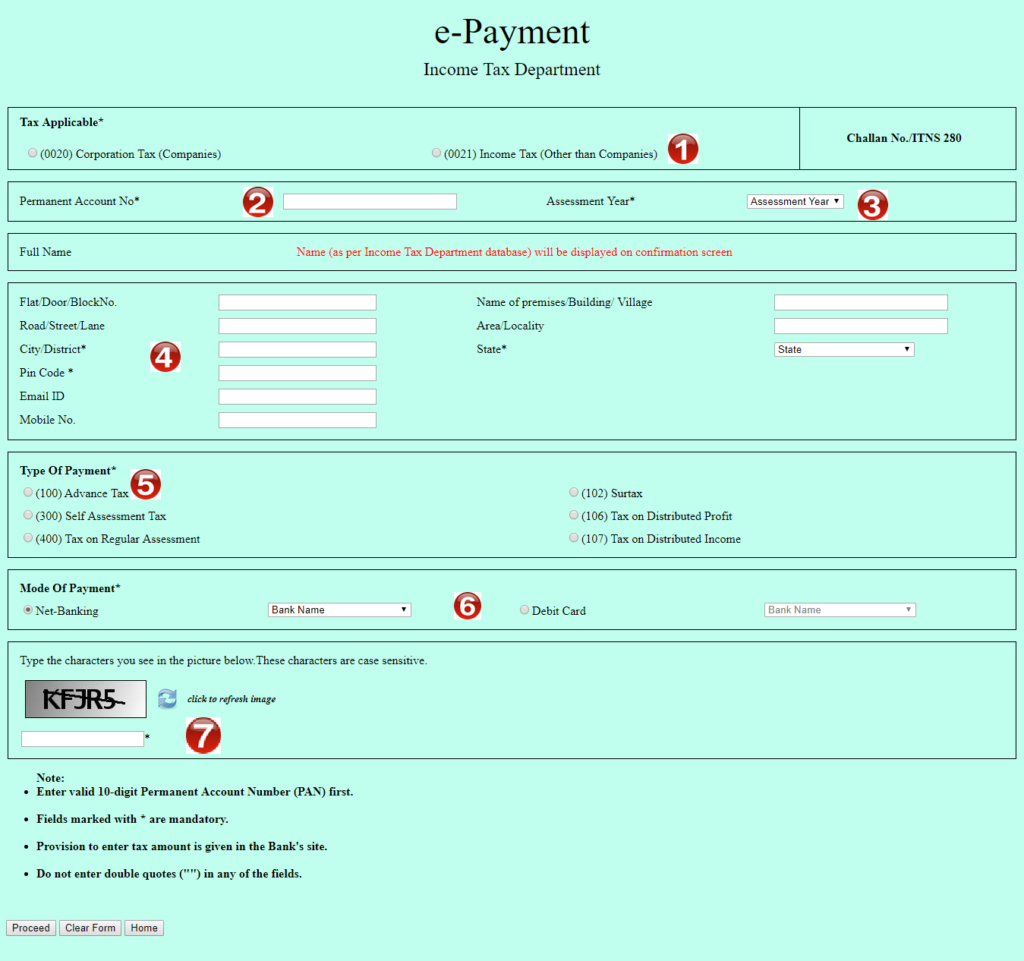

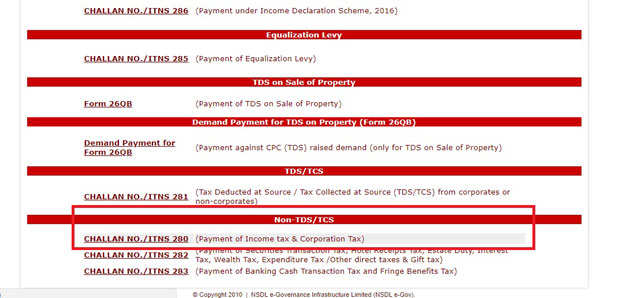

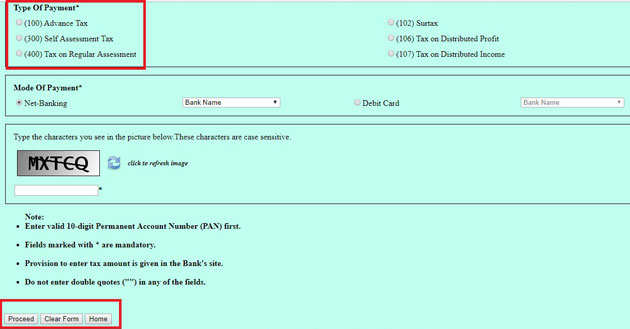

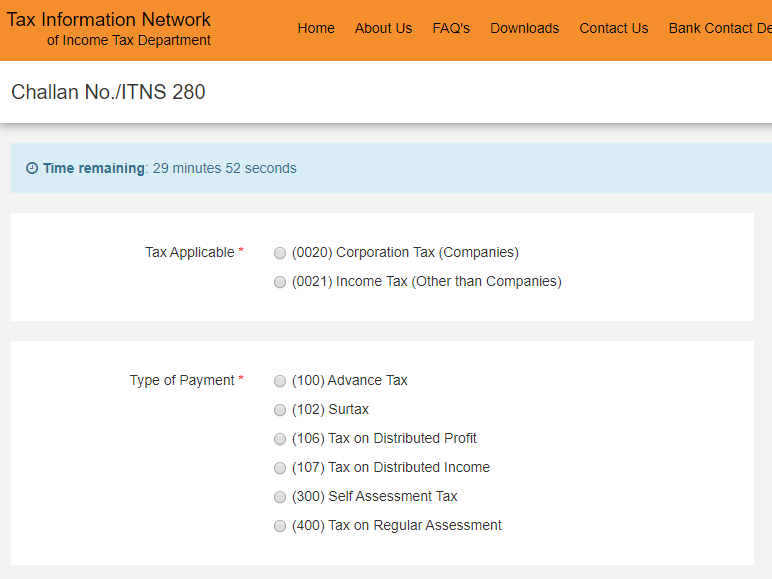

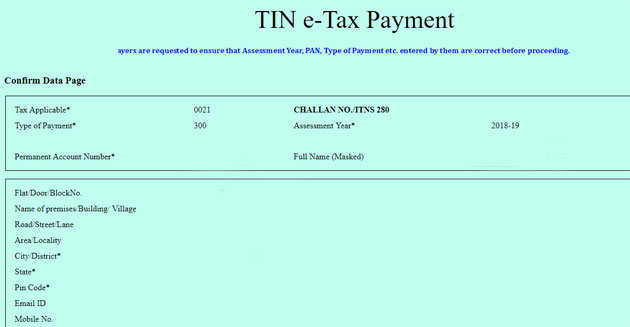

How to pay advance income tax online india. Gupta shall amount to rs. Challan no itns 280 payment of advance tax self assessment tax tax on regular assessment surtax tax on distributed profits of domestic company and tax on distributed income to unit holders. The income tax department will accept advance tax payments until march 31 2017 which marks the end of the financial year.

3 select assessment year 2019 20 for this year tax return. Advance tax can be paid through tax payment challans at bank branches which are authorised by the income tax department. Advance tax applies primarily to self employed people like businessmen professionals freelancers etc.

1 select 0021 income tax other than companies for individual tax payers. Nris who have income of more than rs 10 000 in india are also liable to pay advance tax. Challan no itns 281 payment of tds tcs by company or non company.

Advance tax as the name suggests allows taxpayers to pay their income taxes before the end of the financial year. You are liable to pay advance tax if your estimated income meets the criteria as stated in the current income tax laws. How to file advance tax in india.

5 select 100 advance tax. Steps to file income tax online. Senior citizens who do not have any income from business and profession are exempt from paying advance tax.

The estimated tax liability of mr. It can be deposited in authorised banks such as icici bank reserve bank of india hdfc bank syndicate bank allahabad bank state bank of india and more. 4 fill up your address email phone number.

Gupta is liable to pay advance tax as his tax liability is more than rs. Challan no itns 282 payment of securities transaction tax estate duty wealth tax gift tax interest tax expenditure other. The advance tax facility was la.

3 00 000 the amount deducted by way of tds is rs 2 00 000. Challan 280 online for advance tax payment. 10 000 can avail the advance tax payment facility.

In this case mr. 2 enter your pan card number. The income you earn is taxed in three ways namely a tax deducted at source tds b advance tax payments and c self assessment taxes paid before filing your income tax return.

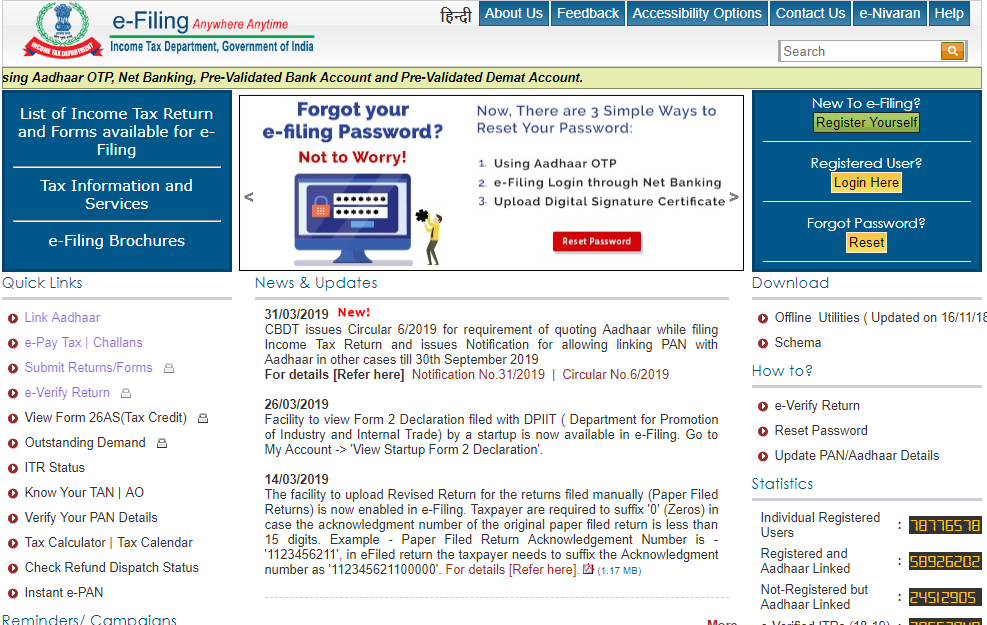

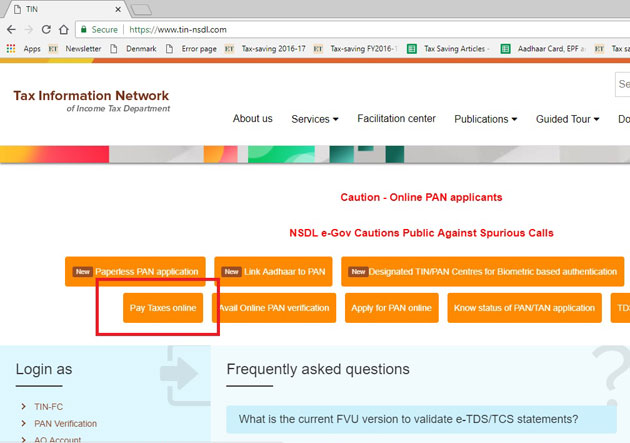

Click the continue to nsdl website button to pay advance tax or self assessment tax. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. Click the login to e filing account button to pay any due tax intimated by the ao or cpc.

Continue to nsdl website. Abhishek soni ceo tax2win an itr filing company says normally an individual whose. Individuals with a tax liability greater that rs.

Gupta aged 45 years salaried person.