How To Pay Advance Income Tax Online For Company

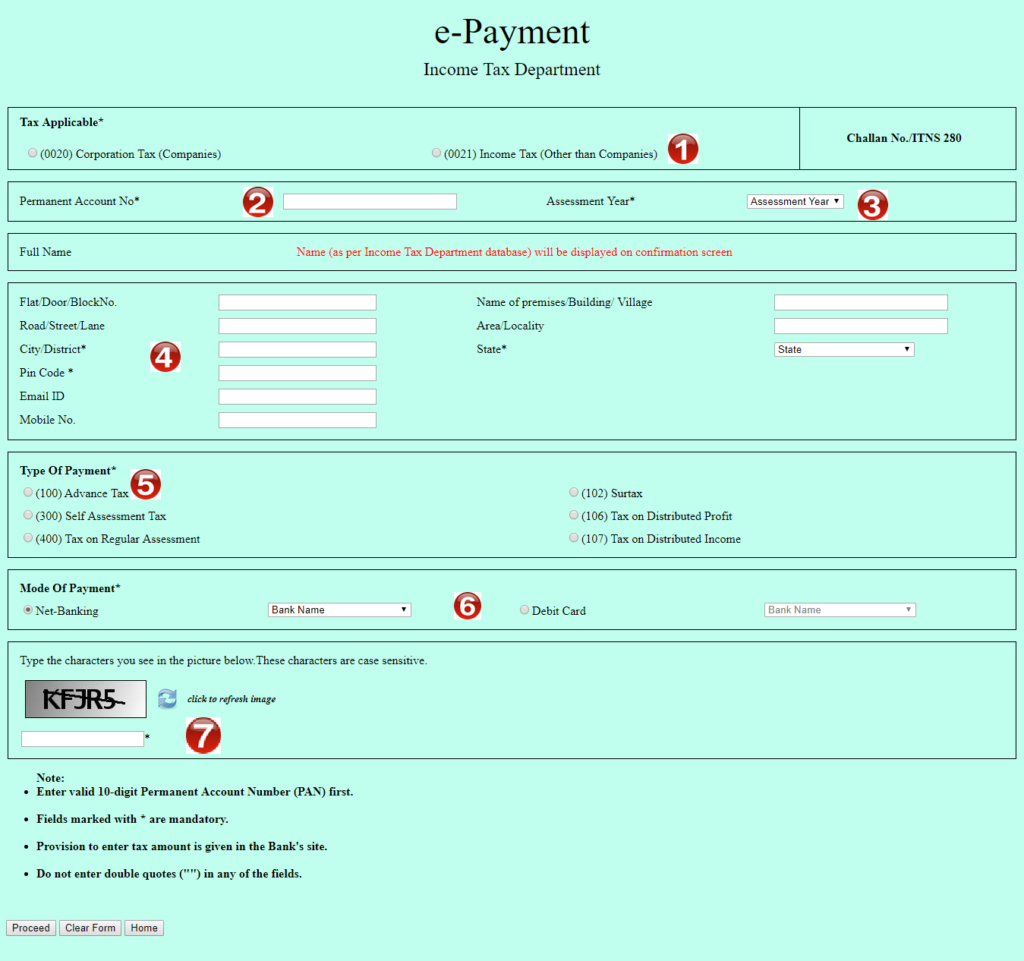

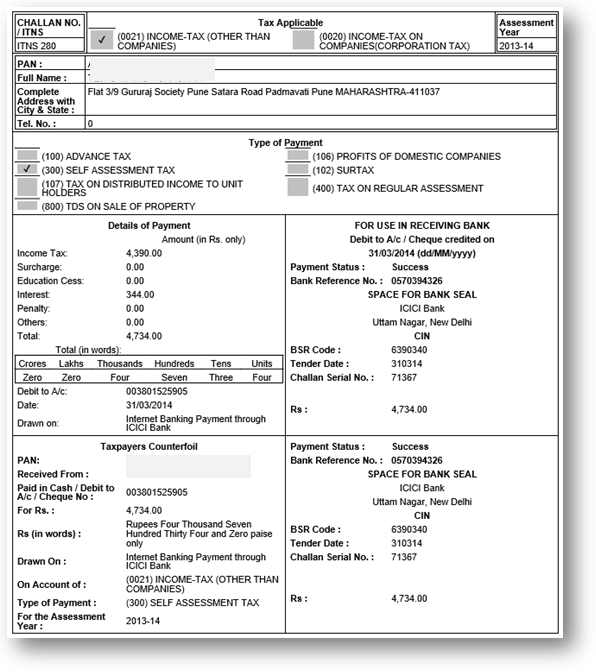

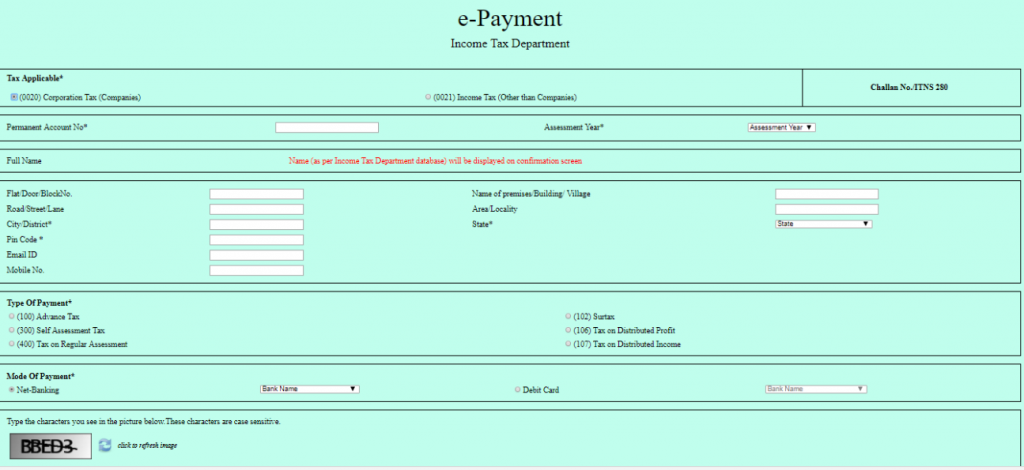

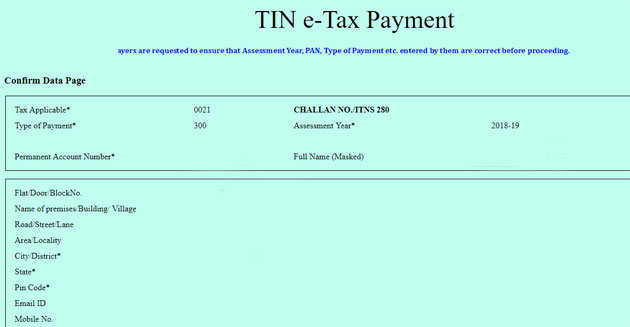

6 select from list of banks or debit card as the case may be i have selected icici net banking.

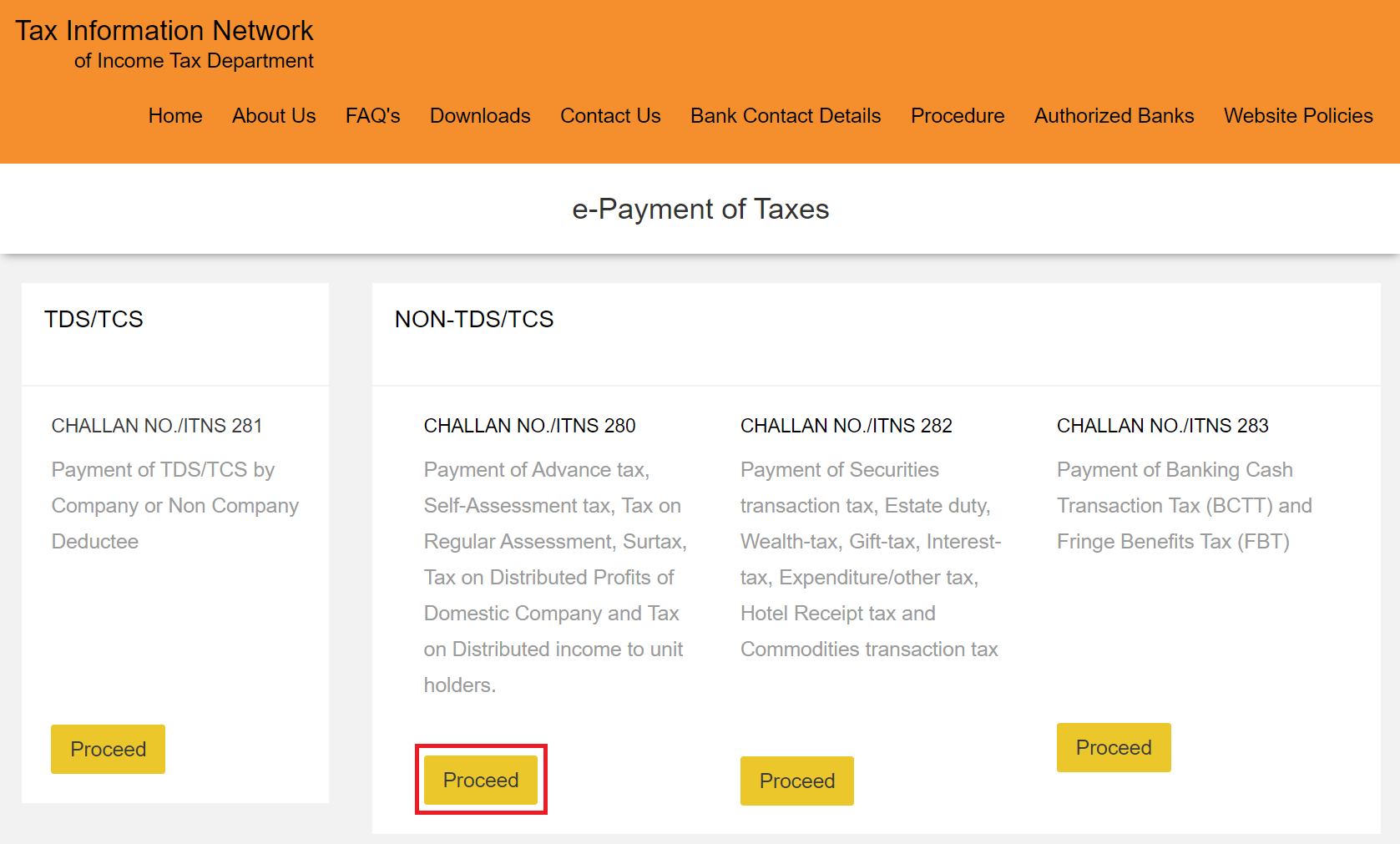

How to pay advance income tax online for company. Credit card payments are not offered by iras directly because of the high transaction costs charged by the credit card service providers. In your case you would not have to pay interest on shortfall in tax deduction and payment. Click services epayement.

How to pay advance tax online. A person has to pay advance tax only when the total tax liability exceeds rs 10 000 in a financial year. You can also use mastercard credit or debit cards to pay tax on axs e station over the internet or axs m station mobile app.

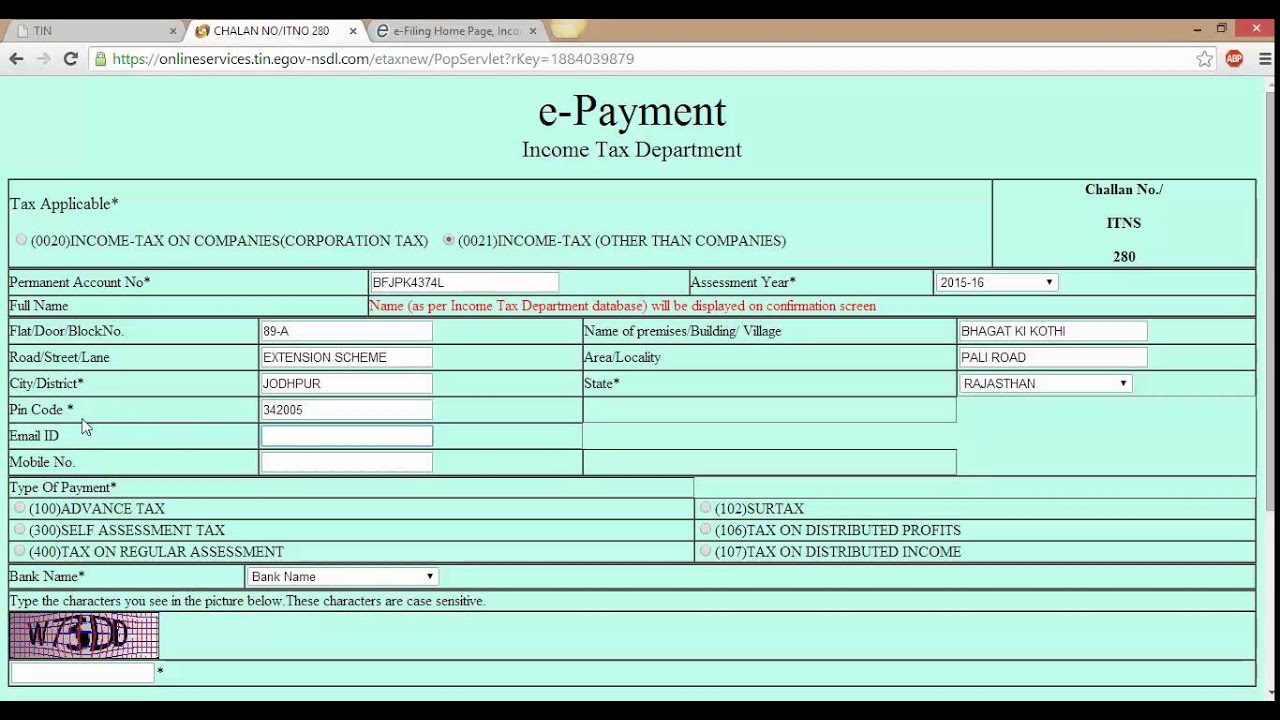

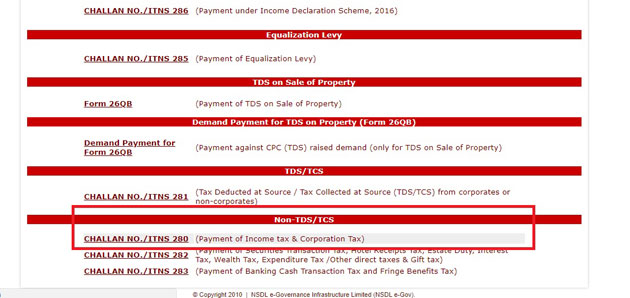

Challan 280 online for advance tax payment. To further ease the cash flow needs for companies in the immediate period it was announced in the resilience budget on 26 mar 2020 that all companies with corporate income tax cit payments due in the months of apr may and jun 2020 will be granted an automatic three month deferment of these payments. 3 select assessment year 2019 20 for this year tax return.

The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. Usually it is expected that you will earn the income first and then pay the taxes on it. The advance tax can be paid online through the online facility offered by the income tax department.

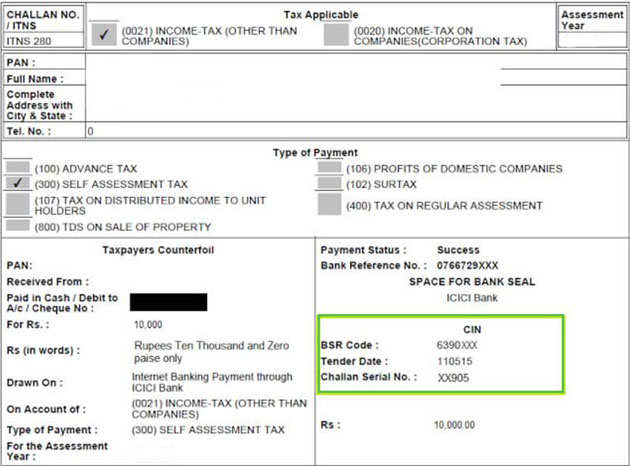

Advance tax provisions are not applicable to senior citizens not having business income. Below is a sample of the generated kra advance tax payment slip. The advance tax payment slip is valid for 30 days after which it will expire if you will not have made payment to the bank.

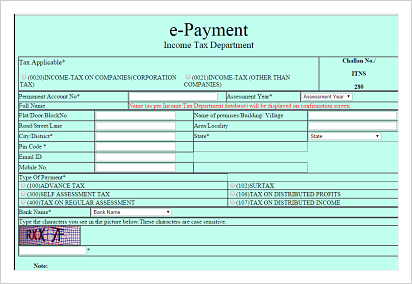

The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. However in case of advance tax an assessee has to estimate his income for the year and pay the taxes partially or fully in advance. 1 select 0021 income tax other than companies for individual tax payers.

5 select 100 advance tax. Let me make it clear about advance tax payment on the web advance tax details advance income tax re payment is mandatory for many assessee whose estimated online payday loans east riding of yorkshire income tax obligation is above в 10 000. 4 fill up your address email phone number.

2 enter your pan card number. You can refer the relevant provisions of the income tax act 1961 for this. In this case the additional income will be deducted from the salary of the tax payer by the employer.

The calculation of advance income tax is made by using the income tax slab. You need to take into account that the advance tax payment slip comprises of two pages. The payment of advance income tax is something that can most certainly be avoided if the tax payer reports additional income to payroll department at the employer organization.