Hong Leong Bank Cheque Clearance

Where documentation are in order and all terms and conditions of the loan are complied with hong leong finance will disburse the loan cashier s order cheque will be released upon satisfactory final searches disclaimer.

Hong leong bank cheque clearance. Local cheque deposit. Loan application is subject to compliance. If you are waiting to issue your cheque then you can issue out your cheque on the following day ie.

Above blr on daily rest on the utilised od amount. No problem if your payee bank in the cheque immediately. Where crediting and paying banks are within same clearing area.

For the operating times of individual bank branches you ll have to check out their schedules on their own respective sites. Cheque processing fee of rm0 50. How long for bank cheque clearance.

Local cheques deposited will be given value after 10 30pm on the next working day provided the local cheque is deposited before the daily cut off time and subject to clearance of float. Alternatively please call our hong leong contact center at 60 183 723 787 to speak to our customer relationship officer. Inward clean bills drawn on hong leong bank for collection.

Affin bank alliance bank ambank bsn cimb 1 hong leong bank hsbc maybank public bank rhb 4. Hong leong one account overdraft od facility fee. Bank negara malaysia bnm introduced the cheque truncation and conversion system ctcs on april 8 2008 to replace the current cheque clearing system.

If you bank in a local cheque say today before 4pm then following can be done. After you have checked the cheque details and filled in your own bank details you can. Furthermore the purpose of this report is to attempt to identify what the future holds for cheques and to recommend methods of dealing with the demands that may arise in the future for a cheque service providing bank.

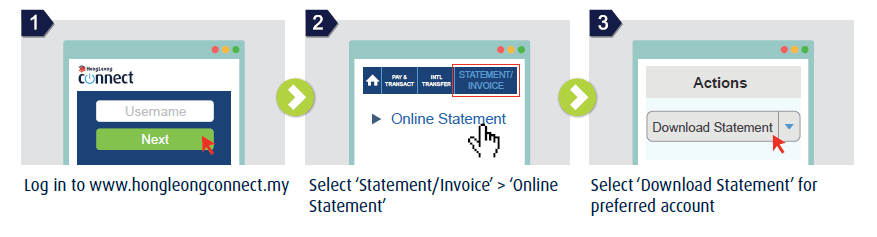

We ve linked a few of them down below. Disclosure of cheque crediting time. Drop cheque at the quick cheque deposit box qcd.

This info applies to all local cheques. Flat 0 1 per item. With the introduction beneficiaries of outstation cheques will be able to use the funds within a shorter period of time compared to the current dayhold of 5 to 8 working days.

2 current system when a customer of bank of china hong kong issues a cheque the payee cashes the cheque at the payee s bank. Hong leong smartlink account cash withdrawal without cheque or cheque encashment performed by 1st party at domicile or interbranch. Posb dbs also have quick cheque deposit machine qcm for their customers.

These collection boxes are available at the banks branches in singapore.