Gst Tax Invoice Ruling

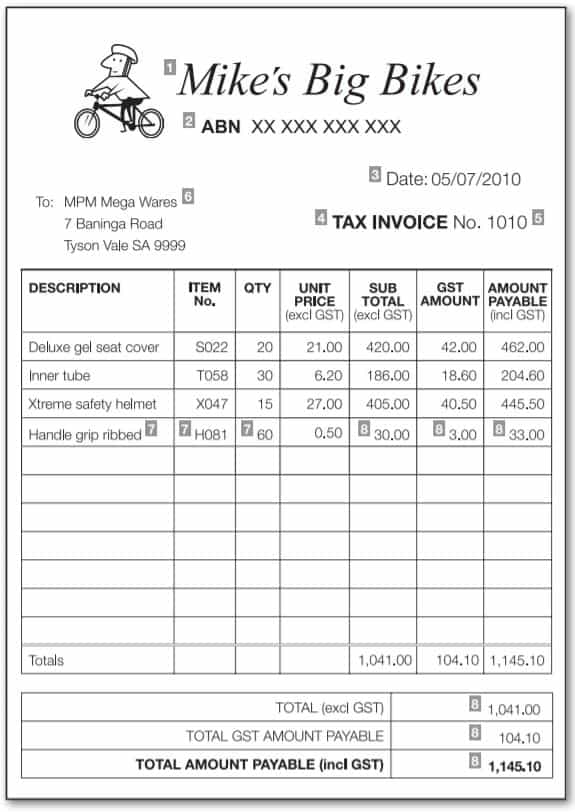

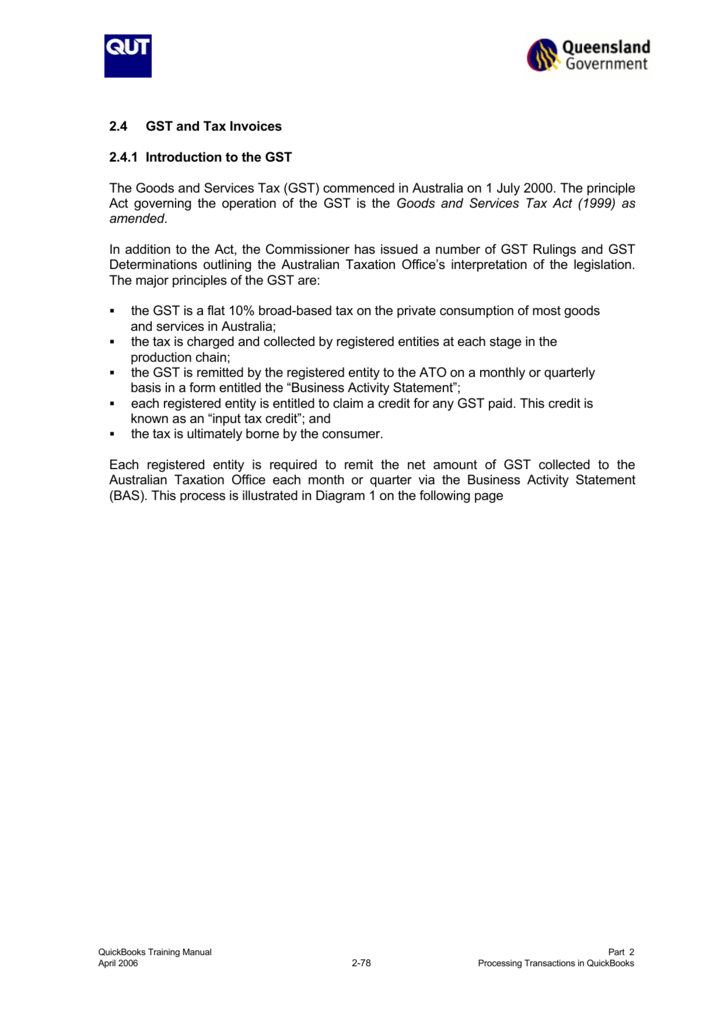

All gst registered businesses must issue tax invoices for sales made to another gst registered business.

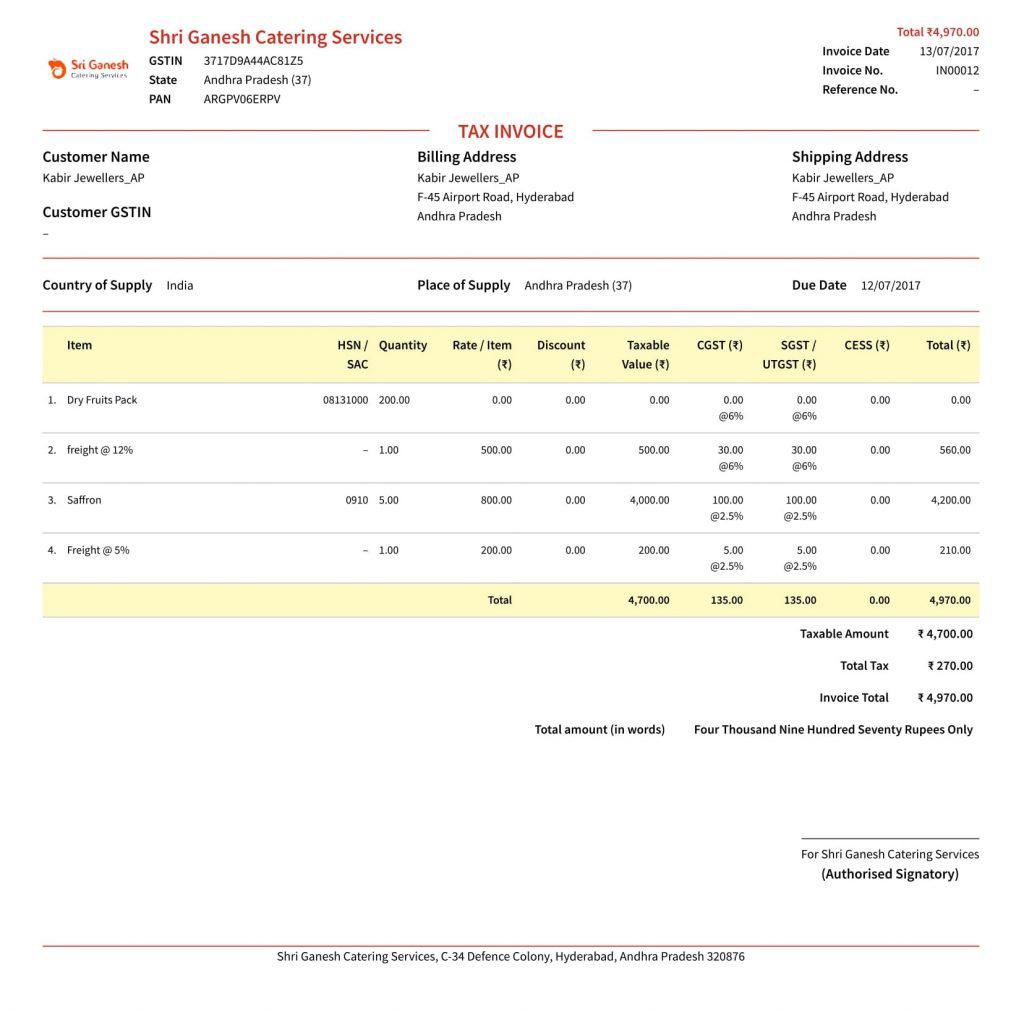

Gst tax invoice ruling. The serial number so mentioned in the gst invoice is said to be a gst invoice number. As per rule 46 of the central goods and service tax rules 2017 the length of the gst invoice number should not exceed 16 characters which means that the gst invoice number can be maximum up to the length of. When gst registered customers need get and issue tax invoices and what the invoices need to show.

Invoice rules and tax frauds. Invoicing under gst supply of goods. Supply of services general case within 30 days of supply of services.

The government has passed legislation regarding the gst tax invoice rules and these were implemented in india on july 1 st 2017 it is necessary for any type of sellers to prepare a valid gst invoice and send it to the buyer for necessary action. How many digits in a gst invoice number. The tax invoice provisions in section 31 are central to the time of supply rules the input tax credit system and the matching mechanism.

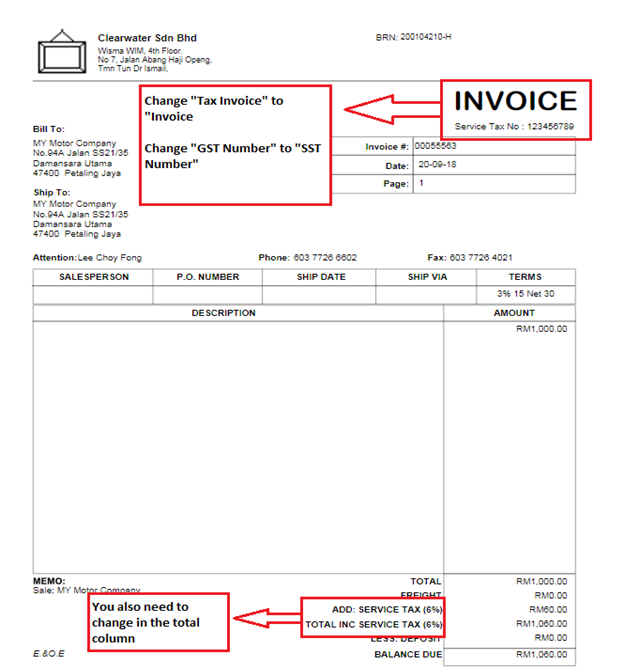

If the value of your supply does not exceed 1 000 you can issue a simplified tax invoice with fewer details. Under the gst regime an invoice or tax invoice means the tax invoice referred to in section 31 of the cgst act 2017. Where there is more than one taxable sale on a tax invoice there are two rules known as the total invoice rule and the taxable supply rule.

Specific accounting rules that apply to exempt zero rated and special supplies. Modified tax invoices sellers who cannot meet our usual requirements for tax. A supplier of taxable goods must issue the tax invoice before or at the time of.

This section mandates issuance of invoice or a bill of supply for every supply of goods or services. Supply of services banks nbfcs within 45 days of supply of services. Time limit to for invoicing under gst.

Buyer created tax invoices in some situations a buyer is in a better position than a seller to issue a tax invoice. Claiming gst you can claim gst on supplies you receive for your business. It is not necessary that only a person supplying goods or services need to issue invoice.

Buyers need to apply for approval to issue invoices. The document proves the time of supply or and receipt of payment. A registered person must issue a tax invoice if he is supplying taxable goods or services.

Following are the time lines for issuing an invoice to customers. Where there is only one taxable sale on a tax invoice the amount of gst should be rounded to the nearest cent rounding 0 5 cents upwards. Rule 47 of cgst rules has defined the time limit for issue of gst tax invoices revised bills debit notes and credit note.

The rules get uniformly applied for all composition dealers. The new invoice rules under gst in 2020 21 focus on ensuring better compliance.