Gst Tax Code Malaysia

The existing standard rate for gst effective from 1 april 2015 is 6.

Gst tax code malaysia. Gst exemptions apply to the provision of most financial services the supply of digital payment tokens the sale and lease of residential. Malaysia gst reduced to zero. Payment code is referring to the type of tax that categorized by inland revenue board irb or lembaga hasil dalam negeri lhdn malaysia.

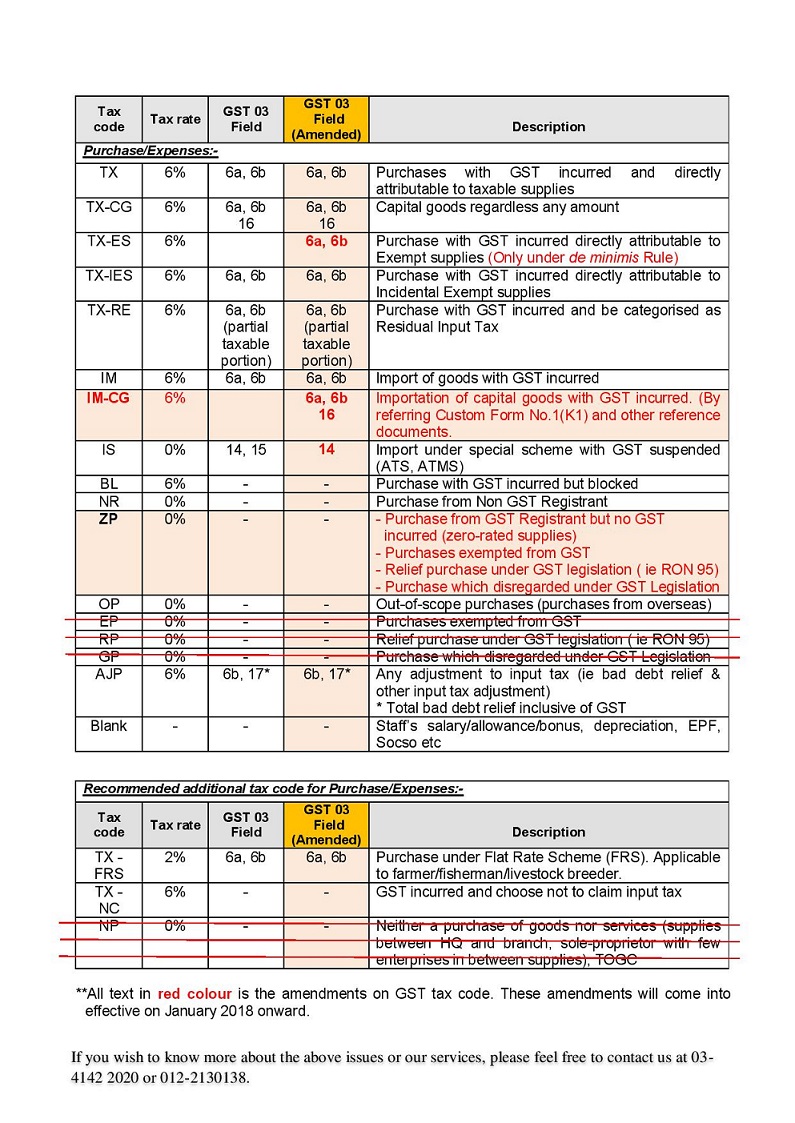

Refer to q14 in faq 28eng29 updated 17 5 18281pm29 pdf uncleared with the tax code either to use new tax code or zrl since it should be recorded in gst 03 return column 10 11 ajs s any adjustment made to output tax e g bad debt recovered other output tax adjustments. Knowledge of the 23 recommended tax code and correct setup at the initial stage is crucial to ensure the correctness of gst return submission. Purchase transactions which disregarded from charging and payment of gst under gst legislations.

Refers to all goods imported into malaysia which are subject to gst that is directly attributable to the making of taxable supplies. The gst tax codes for purchase are as the following. Gst is levied on most transactions in the production process but is refunded with exception of blocked input tax to all parties in the chain of production other than the final consumer.

Examples of zero rated supply as prescribed based on tariff code in gst zero rated supply order 2014. While making tax payment through various tax payment options taxpayers have to specify a few information such as name of taxpayer employer income tax number employer number identity number and payment code. We would like to introduce the 23 recommended tax codes for your reference.

In other countries gst is known as the value added tax or vat. Example for this tax code are purchase of ron95 petrol diesel and other relief supply that been given relief from gst as prescribed under gst relief order 2014. Tx 6 is a gst.

Apa apa permohonan rayuan cbp. Goods and services tax or gst is a broad based consumption tax levied on the import of goods collected by singapore customs as well as nearly all supplies of goods and services in singapore. Gst tax codes in malaysia are defined as recommended code listings in order to allow proper classification of different purchase and supply transactions and these codes are based on common scenarios that are commonly encountered by gst registered companies in malaysia.

Tax code mapping for gst related transactions and gst accounting entries are new to most of the accounting personnel in malaysia. The ministry of finance mof announced that starting from 1 june 2018 the rate of the goods and service tax gst will be reduced to 0 from the current 6 for more information regarding the change and guide please refer to.