Gst Input Tax Credit Time Limit Notification

However as per the provisions of section 16 3 the input tax credit on the said tax component shall not be allowed if the registered person has claimed depreciation on the tax component of the cost of capital goods under the provisions of the income tax act of 1961.

Gst input tax credit time limit notification. Receipt of goods and or services. Since dual benefits cannot be awarded to the taxpayer under both the gst laws and the income tax act simultaneous the benefit. The proviso so inserted reads as below provided that where any time limit for completion or compliance of any action by any authority has been specified in or prescribed or notified under.

Gst input tax credit time limit. 35 2020 central tax dated the 3rd april 2020 which was amended by notification no. Possession of a tax invoice or debit note or document evidencing payment.

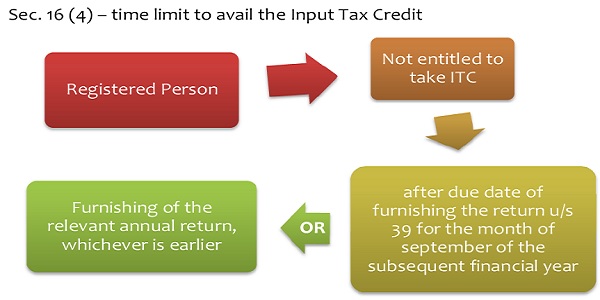

There are different situations wherein the inputs can be claimed for semi finished goods or stock or finished goods. The time limit to avail gst itc. Section 16 4 similar to the restriction under the cenvat credit rules 2004 availing input tax credit hereinafter referred to as itc under gst also is time bound the relevant provision in this regard is section 16 4 of the central goods and services tax 2017 hereinafter referred to as the act which reads as under.

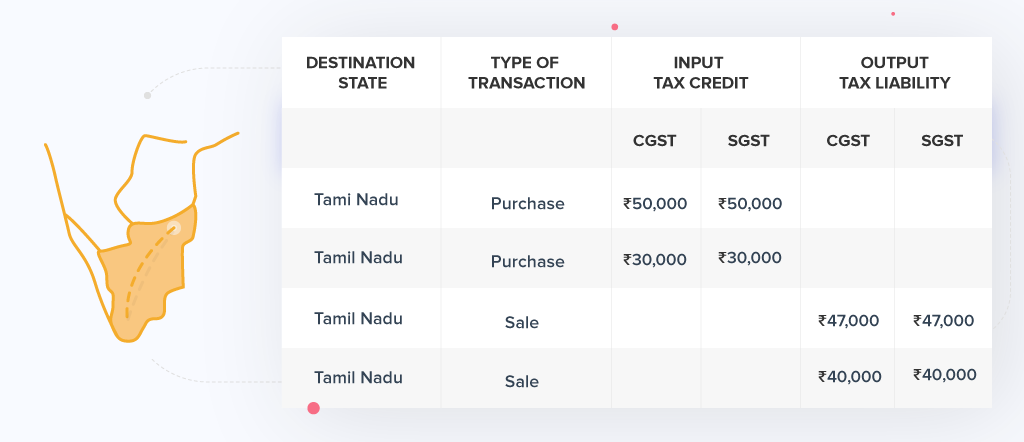

55 2020 central tax dated 27th june 2020. In the above example mk kitchen knives has a total input tax credit of rs 80 000 rs 50 000 rs 30 000 from both cgst and sgst. Period prior to 1 2 2019.

A proviso has been inserted in clause i of the notification no. Itc can be availed by a registered taxable person in a specific manner and within a specified time frame. There may be many instances wherein you may have not taken input tax credit on the invoices received from 01 07 2017 to 31 st march 2018 from your supplier.

Therefore if you have such invoices and you want to claim itc then you can book and take such credit before filing gstr 3b for the month of september 2018. Notifications issued for implementing the decisions of 40th gst council meeting eighth amendment 2020 to cgst rules in wake of covid pandemic date further extended till 31 08 2020 for certain compliance under gst laws and till 30 09 2020 for certain compliance customs central excise and service tax laws removal of difficulty order issued regarding extension of time limit for filing an. A registered person will be eligible to claim input tax credit itc on the fullfilment of the following conditions.

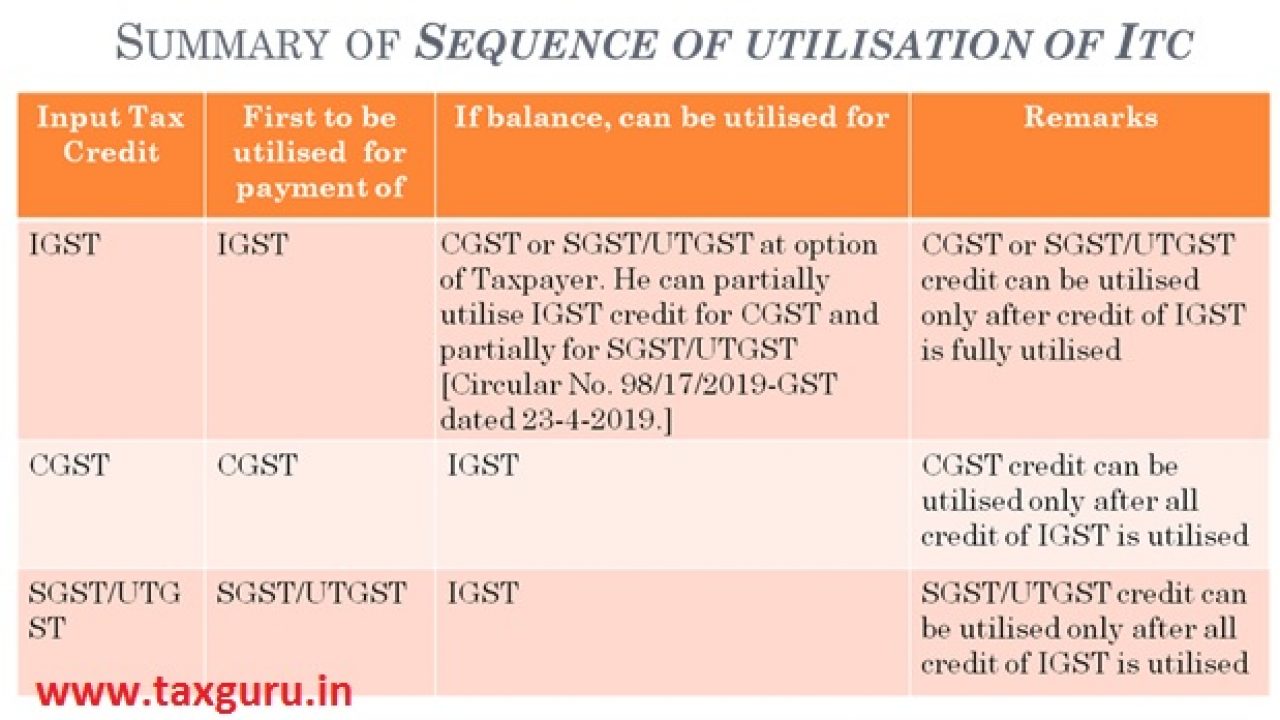

Based on the tax offsetting rules under gst they use the cgst input tax credit worth rs 80 000 to offset the cgst liability of rs 87 000 rs 47 000 rs 40 000 once this adjustment is completed the remaining cgst liability is rs 7 000 rs 87 000 rs 80 000. 98 17 2019 gst dated 23rd april 2019 the common portal currently supports the order of utilization of input tax credit in accordance with the provisions before implementation of the provisions of the cgst amendment act i e. Notifications issued for implementing the decisions of 40th gst council meeting eighth amendment 2020 to cgst rules in wake of covid pandemic date further extended till 31 08 2020 for certain compliance under gst laws and till 30 09 2020 for certain compliance customs central excise and service tax laws removal of difficulty order issued regarding extension of time limit for filing an.

A registered person shall not be entitled to take input tax credit in. Note that as per circular no.